What is an Angel Investor? Angel Investment Platforms

Do you have a startup company? Or is the future of your company in question? If you want to grow your business and venture into different business lines at the same time and do you need financial support. Without further ado, let’s start our guide by answering the question “What is an Angel Investor?”

What is an Angel Investor?

We can explain the concept of angel investor in the simplest words: it represents individual persons who provide financial support to new or developing companies. In short, they are individuals who believe in the business ideas and business plans of entrepreneurs and want to support their success.

These platforms usually use their own capital to provide capital to entrepreneurs and in return for these investments, they own a part or shares of the company. Angel investors can also provide resources such as mentoring and advice to help entrepreneurs manage their companies.

Angel investors can be a great resource for entrepreneurs with new and innovative ideas and play an important role in the business world.

How Many Percentage Shares Do Angel Investors Buy?

This means that when investing in new or emerging companies, they usually own a part or shares of the company. The proportion of shares that investors will own in the company may vary depending on factors:

- Amount of investment

- The value of the company

- Contribution to the company’s growth

The shareholding may vary according to the size of the investment and the value of the company. Generally, they may own between 5 per cent and 25 per cent of the investee company. However, when the amount of investment is large and the value of the company is high, they may receive fewer shares.

You may be be interested: Crypocurrency Markets

What Does an Angel Investor Want?

Angel investors generally expect that the venture they are investing in has growth potential. It is useful to pay attention to the following features when presenting your project.

A good business idea: They want the venture to be invested in to have an original and innovative business idea.

A strong team: In addition to a good business idea, they also want a strong team. It is important for investors that the founders of the venture are experienced, passionate and complementary to each other.

Growth potential: The angel investor wants the venture to have growth potential. The size of the market targeted by the business idea is an important indicator of how much the venture can grow.

Return on investment: They want to get a return on their investments. For this reason, factors such as how much profit the invested venture can make and how long the investment can return are also important.

Risk management: They want to understand and manage the risks of the venture with a good reports of the financial and legal status of the venture. Also, you have to identify the risks clearly. It is an important factor for investors to consider when making a decision.

it is difficult to move forward for startups.

What are Angel Investor Platforms?

The angels of the entrepreneur do not always come across at once. For this reason, you may also need intermediary angel investment networks where you can reach them. Some of the platforms that enable communication between entrepreneurs and investors are as follows:

- Angel Capital Association

- Angel Forum

- Angel Investment Network

- AngelList

- Envestors

- Funded

- FundingPost

- Golden Seeds

- Gust

- Wefunder

What Should Angel Investor Characteristics Be?

When you decide to get support for your business, choosing the right investor is very important. You need to evaluate him/her as he/she will evaluate you. Instead of meeting with only one of them and making a decision, it will be to your advantage to meet with other angel investors who can support your business.

Entrepreneurship experience: Experience in the entrepreneurial world should help them understand what businesses with growth potential can achieve and what may not work.

Financial knowledge: It is important that they have knowledge in financial matters. Understanding the financial structure of the businesses they will invest in helps investors make the right decisions.

Sector knowledge: They should have information about the sectors in which the businesses they will invest in operate. In this way, they can evaluate the potential and risks of the business.

Networking ability: They should have enough network to connect with other important players in their sectors and provide new opportunities for their businesses.

Risk-taking ability: These people cannot be sure that the businesses they will invest in will be successful. Therefore, they should be able to take risks.

Patience: The early stage is a period when the investor does not expect to get a return. They need to be patient to wait for the business to grow. This can take time and it is important for investors to be patient.

Mentoring: Angel investors can act as mentors for the development of the businesses they invest in. The guidance, advice and experience of entrepreneurs can help businesses grow faster.

How the System Works?

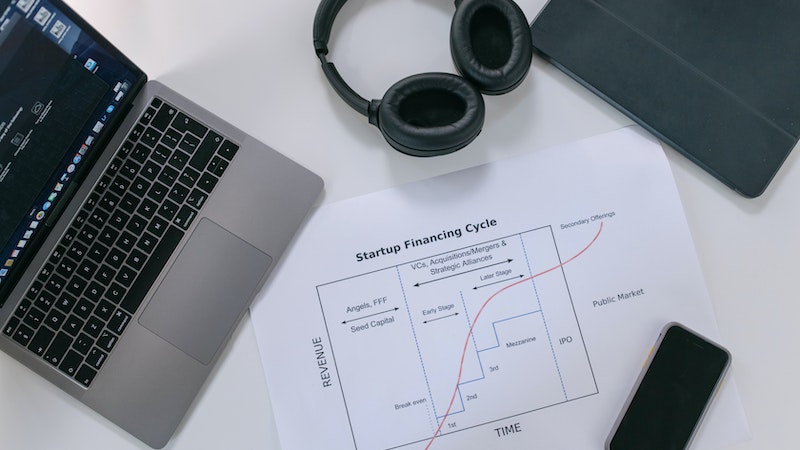

In this system, individual investors invest in ventures, helping them to grow and continue their activities successfully.

Angel investors generally use their own capital. The size of the investment may vary depending on the investor’s individual preference and financial situation. They help startups with financing, mentoring and business management.

When making a selection, many factors are taken into account. A good business idea, a strong team, growth potential, return on investment and risk management are among the factors that angel investors pay attention to. The ventures to be invested in must meet the investment criteria of angel investors.

Angel investors own a share in the ventures they invest in. As the venture grows and its value increases, the investments of angel investors also gain value. Angel investors usually make a profit by selling the shares of the ventures after a few years in order to get a return on their investments.

In addition to these characteristics, other characteristics such as the ability to communicate with entrepreneurs, having a vision, being prone to teamwork, being open to innovations and adapting to changing market conditions are also important to be a good angel investor.